The number of households switching their energy supplier could skyrocket from July 2023, as falling energy wholesale prices coupled with reduced government support look set to provide suppliers with the chance to offer millions of domestic customers more competitive deals, according to analysis by energy consultancy Cornwall Insight.

Since the start of winter, the default tariff cap, or price cap, and the Energy Price Guarantee (EPG) have left the government-supported Standard Variable Tariff (SVT) lower than almost all energy tariffs – effectively constraining the savings households can make by switching. Seeing no incentive to switch suppliers and save money, household switching rates dropped from an average of 496,000 electricity supply points moving per month in 2019 to just 85,000 per month in 2022.

With government support through the EPG rising to £3,000 in April, and decreasing wholesale prices lowering supplier costs, there is a good chance, that suppliers will be able to offer fixed tariffs that compete with the capped government prices, reviving the benefits of switching suppliers. Although such an outcome is subject to wholesale market volatility, early indications are that suppliers may be able to offer competitively priced tariffs within a matter of weeks.

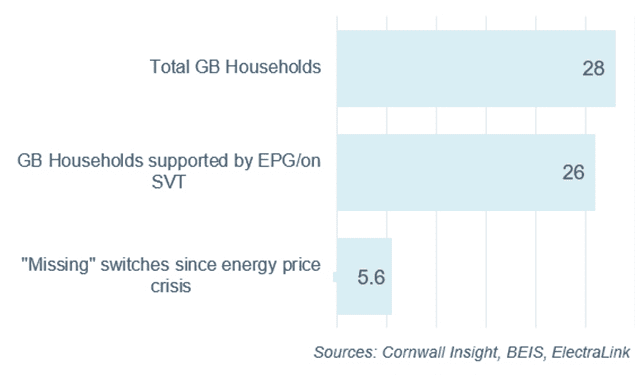

Using the average switching rates from the two years up to October 2019 as a baseline, approximately 5.5mn switches that might have been expected did not occur. While some of those switches would have been customers moving suppliers more than once, and gas supply is not included, this is an indicative figure of how many households may be ready to mobilise when supplier products start beating the standard variable rates.

In examining the potential for switching, we note that if the wholesale market volatility, as experienced in 2022, returns, it could become uneconomic or impractical for suppliers to offer the kind of competitive tariffs in question. However, the current market conditions suggest there may be room for households to have a wider engagement in the energy market than they have in recent times.

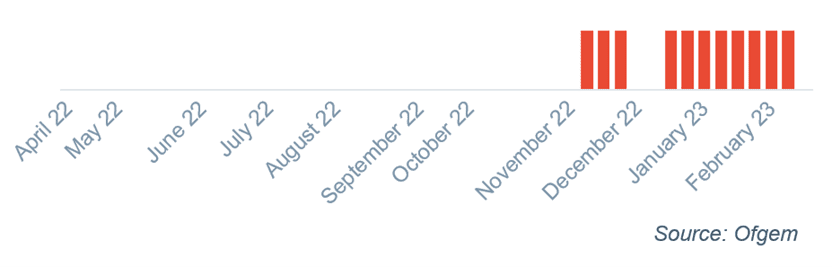

How suppliers purchase energy impacts the prices they offer customers. If they hedge by purchasing energy in advance and the wholesale price falls unexpectedly, they may not be able to lower their prices relative to competitors who have not hedged. This could cause customers to switch to rival suppliers. In part to avoid suppliers failing, which could raise energy bills, Ofgem introduced the Market Stabilisation Charge (MSC). If wholesale energy prices drop by more than 10% from when the current price cap was set, the supplier that gains a customer pays the supplier that lost a customer in line with the MSC. The MSC has been triggered since late December 2022 due to falling wholesale prices, but the EPG has limited customer incentives to switch suppliers.

While the MSC does encourage responsible hedging practices, it also means suppliers may not be able to offer deals at prices as low as they would have liked due to the cost implications of the MSC. As wholesale prices could further drop in 2023 and the MSC be triggered more frequently, the effectiveness of the MSC tool will face greater scrutiny.

Kate Mulvany, Senior Consultant at Cornwall Insight said:

“The energy market is complex, making it difficult to predict the effects of policy changes on consumer behaviour and energy pricing. However, if suppliers’ costs decrease and government-supported rates remain relatively high, it is likely we will see a significant revival in reasonably priced energy plans, with millions of households finally able to take advantage of the savings they have been missing out on for years.

“There are many variables still in play, and it is difficult to know how fast and how far energy bills will fall. The Market Stabilisation charge adds another level of complexity, as while it may safeguard against supplier collapse it is likely to drive up the cost of energy deals offered by suppliers.

“To see rising switching we are also relying on consumers engaging with an energy market which many are understandably wary of. It is possible some households may choose to stick with what they know instead of choosing cheaper options.”