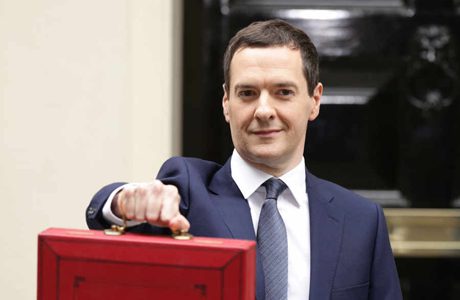

George Osborne’s 2016 budget on 16 March included announcements related to flood resilience and the effort to tackle climate change, alongside further tax cuts for the fossil fuels industry, with commentary and responses forthcoming from environmental groups within a short period of his presentation.

On climate change, relevant announcements include an increase in the climate change levy, effective from 2019, an end to the carbon reduction commitment energy efficiency scheme, and the availability of £730m to invest in renewables.

While £730m of funding for renewables is to be welcomed, ReFood commercial director Philip Simpson felt this was only “a drop in the ocean”, and not enough to allow the sector to really achieve its potential.

“Today’s Budget is another signal that the environment and renewable energy is far from the top of this government’s agenda. It was thoroughly disappointing to see that renewable energy generators are hit once more as the Chancellor announces rises to the Climate Change Levy, which became applicable to such businesses for the first time in 2015.”

Dale Vince, founder of wind and solar energy supplier Ecotricity, commented. “The budget is remarkable not so much for what’s in it, but for what’s not; the chancellor forgot to mention a little thing called climate change – and in the same week that NASA called February’s global temperatures ‘stunning’ and scientists from around the world declared a climate emergency.

“Only two days ago, our own government promised to set a net zero emissions target into law, as agreed by the whole world in Paris just a couple of months ago.

“What is this budget, and this Chancellor, doing on this front? Very little it seems.”

Carbon composure

IEMA offered a nuanced response, and said it was “pleased” by Osborne’s decision to retain Mandatory Carbon Reporting, but was more ambivalent on the scrapping of the carbon reduction commitment, commenting that “the Chancellor’s approach to replacing the revenue raised from CRC allowances in a ‘fiscally neutral way’ by simultaneously increasing the Climate Change Levy could be a concern as such a tax may be difficult to make effective.” However, IEMA felt that the timeline for these changes “feels positive”, adding that “the expected consultation has been announced – and indication that the new simplified policy regime will be in place from 2019 is also a welcome move.”

The budget also contained a £700m increase for flood defences and an increase in the insurance premium tax to 10%, from 9.5%, increasing the revenue that will be available to tackle future floods.

IEMA commented: “This budget is interesting as that longer term issues are being addressed in some areas, such as a new sugar levy and an increase in insurance tax that will raise revenue to improve flood resilience. However, some opportunities around environmental taxation are not being maximised and freezing fuel duty could be seen in this context. Where taxation is applied there is a concern that the impact and visibility of the increased Climate Change Levy might be very low as the tax will be spread over such a wide number of businesses.”

The decision to provide around £1 billion of tax cuts to the fossil fuels industry by cutting the supplementary charge on oil and gas from 20% to 10% received criticism.

Greenpeace commented: “It makes no economic or environmental sense that the government is cutting support for renewable energy whilst seeking to prop up a North Sea oil and gas sector. Clean energy could power the UK in the future if they were given a sliver of the financial and political backing that is given to the nuclear or fossil industries. Rather than hoping to extract more North Sea oil and gas, the government should be looking at a transition plan for the communities impacted by a declining industry including expanding offshore wind.”