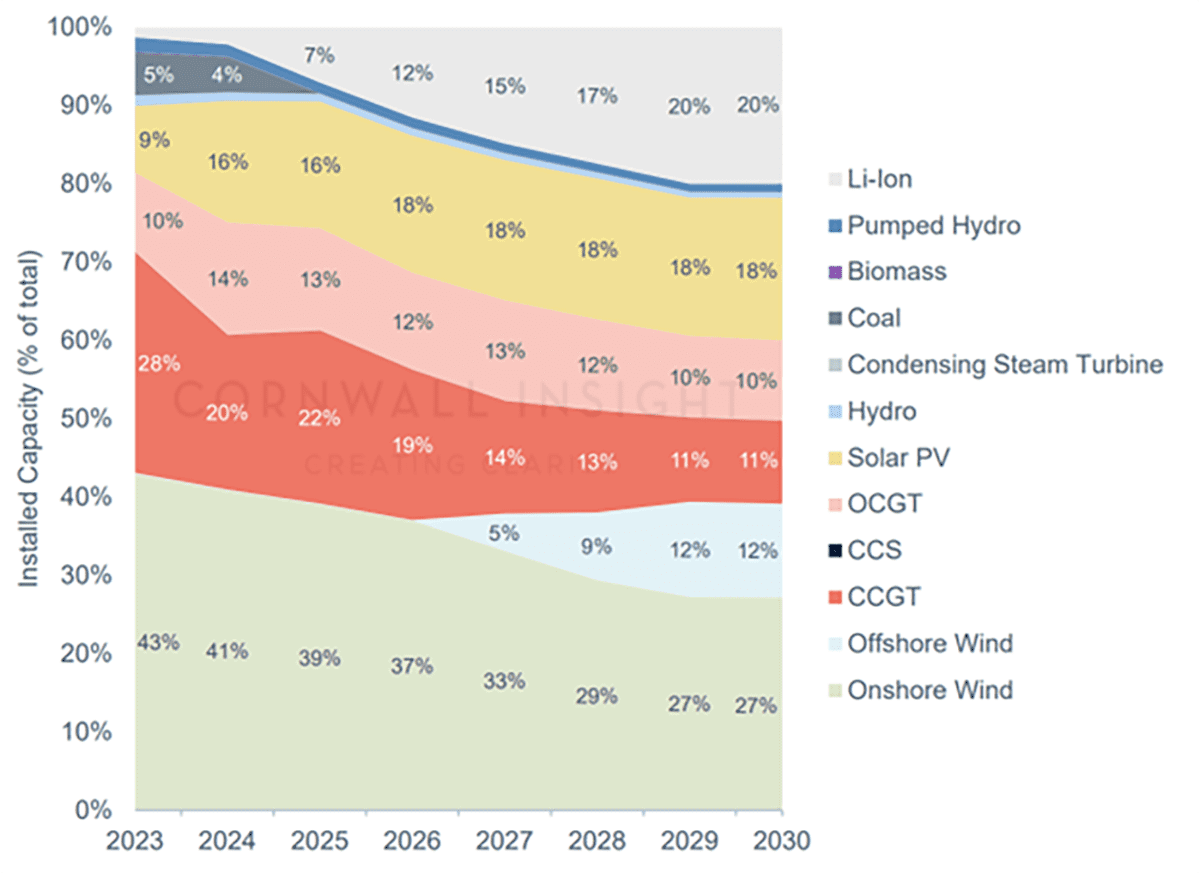

Data from energy consultancy Cornwall Insight Ireland’s third ‘All-Island Power Market Outlook to 2030’ report has forecast Ireland is set to reach its 80% renewable target by 2030, with the increased energy security helping to stabilise the market and lower long-term energy prices. The report covering both Northern Ireland and the Republic of Ireland demonstrates the impact increased government investment in renewables could have on market prices as it strives to meet 2030 targets.

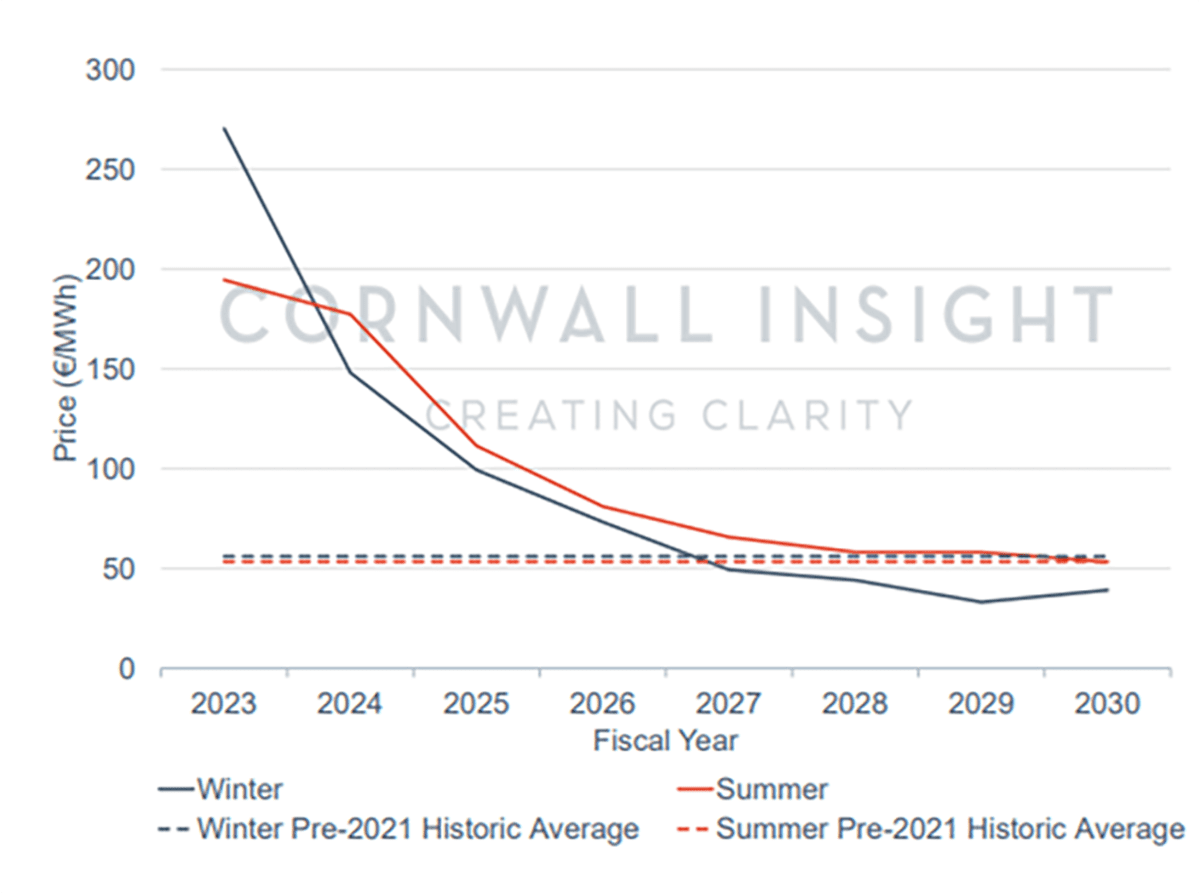

The commissioning of new, low marginal cost solar and offshore wind power, alongside increased battery storage, are forecast to help lower winter energy prices below the pre-2021 historical average from 2027 onwards, with solar power becoming nearly a fifth of the energy capacity by the middle of the decade.

While dropping significantly from recent highs, summer power prices are not forecast to go below historic levels this decade, as periods of low wind leave high-cost gas playing an increased role during this period.

Other drivers of the drop in prices, and the stabilisation in the later part of the decade, include the closure of higher marginal cost coal and oil-fired plants, including Kilroot, Tarbert and Moneypoint, as well as the completion of the North-South interconnector, linking Northern Ireland and the Republic of Ireland, which will improve network efficiencies.

In the shorter term, the continued Russian gas supply uncertainty in the EU, exacerbated by prolonged outages of French nuclear capacity and low rainfall levels affecting Norwegian hydro, are continuing to add significant risk premiums to the gas forward curve, with increasing gas prices making periods of low renewable availability more expensive. Moving further through the decade, an increase in battery storage capacity means renewable energy can be stored for use during periods of low wind and solar generation, with prices forecast to start reducing during these times.

Ratnottama Sengupta, Senior Consultant at Cornwall Insight, said:

“Currently, the global energy market is in turmoil as it grapples with supply disruption caused by geopolitical and environmental instability. Ireland’s many years of over-reliance on imported energy has left them vulnerable to higher prices, as energy security and possible supply cuts continue to be a concern for the upcoming winter. In the long run for Ireland our data shows a clear path; only through pulling away from high-cost, volatile gas towards lower-cost renewable generation, supported by battery storage, will all of Ireland be able to secure its electricity supply and protect itself from the high international energy market wholesale prices.

“The road to a secure, clean, low-cost energy supply for all of Ireland will be a slow process, with the continued reliance on gas leaving winter energy prices above historic levels until the later part of the decade. The picture is even less optimistic during the summer, with periods of low renewable generation leading to slower price reductions and wholesale costs stabilising at a higher level. Ultimately our data shows the country struggling with the question many have asked of renewable reliance before, how do you manage security of supply when most of your generation mix is driven by variable sources?

“The forecast increase in Li-on battery storage will be part of the drive to lower summer energy prices, driving the replacement of more expensive fossil fuelled backup generators (like coal or oil) and allowing the system to still rely on low-cost renewable resources during periods of low solar and wind generation. Hopefully, the Irish energy market will continue on this trajectory, and we will see prices during the summer reduce below historical levels as we move past 2030.”