UK-based technology firm Altilium has announced a US$5m (around £4.07m) investment to help develop its circular offering for EV batteries, as part of its Series B funding round. The strategic investment comes from Japanese trading and investment group Marubeni Corporation.

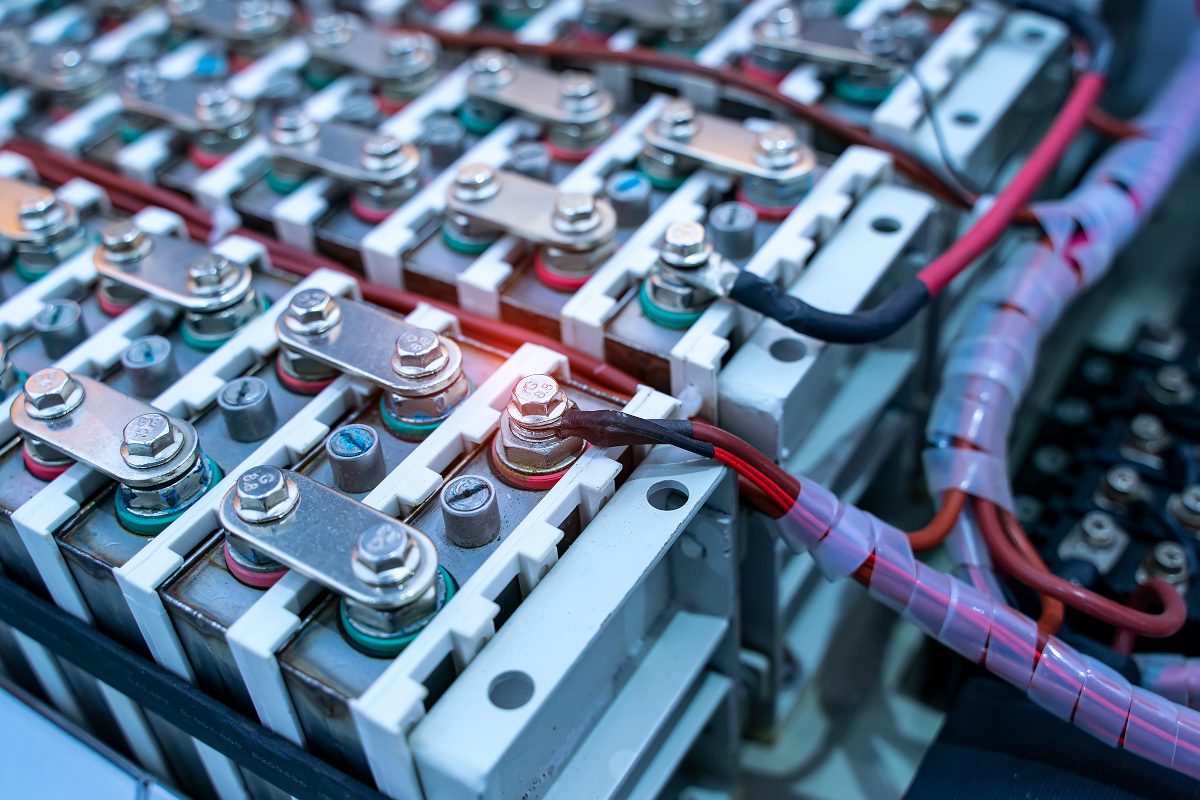

Altilium said the investment supports its mission to deliver the UK’s most sustainable lithium-ion battery materials, through its full battery circularity offering, encompassing zero-carbon EV battery collection, black mass recycling and chemical refining to battery metals salts, cathode precursor (pCAM) and cathode active materials (CAM). This will include the construction of the UK’s largest planned EV battery recycling facility, to be located in Teesside.

Marubeni’s strategic investment in Altilium will support the next stage of development for the Teesside facility, including detailed engineering studies, land acquisition, planning and permitting, and recruitment of the key leadership team. Once operational, the plant will have capacity to process battery waste from 150,000 EVs per year, producing 30,000 MT of low carbon CAM. This would be enough to meet 20% of the UK’s CAM requirement by 2030.

Altilium says it is at the forefront of developing a sustainable circular economy for battery materials in the UK, reducing dependency on international supply chains and saving natural resources. The company’s EcoCathode™ technology is described as being able to recover over 95% of the battery metals from an end-of-life EV battery, reducing the cost of battery raw materials by up to 20% and cutting greenhouse gas emissions by up to 74% compared to virgin materials.

Kamran Mahdavi, CEO of Altilium, commented: “We are proud to welcome Marubeni as a strategic partner at this pivotal stage in Altilium’s growth journey. Their investment strengthens our position as leaders in sustainable battery materials and reinforces our commitment to building the UK’s largest EV battery recycling facility. Together, we are advancing our mission to create a UK closed-loop supply chain, reduce dependency on imported materials and lowering the environmental footprint of battery production. This partnership marks a major milestone in establishing a truly circular economy for the UK’s battery industry.”

Altilium and Marubeni have been working together closely since the signing of a Memorandum of Understanding (“MOU”) in 2023. Under the framework of the MOU, the two companies have been jointly developing a closed loop EV battery recycling business in the UK and establishing a supply chain of end-of-life lithium-ion batteries for recycling at Altilium’s facilities.

Marubeni has been involved and grown its presence in the battery material industry since 1985. In recent years, Marubeni has been actively involved in the battery recycling business following its investment into the U.S. recycling market. Under its Mid-Term Management Strategy GC2024, Marubeni has set out its green strategy. Through this investment, Marubeni will continue to build a sustainable supply chain of critical metals, which are essential for transitioning to a decarbonized society.

Altilium completed its Series A funding round earlier this year with a US$12m investment from SQM Lithium Ventures, the corporate venture arm of the lithium business of Sociedad Quimica y Minera de Chile (SQM), one of the world’s leading producers of battery-grade lithium.